Income Tax On Dividends 2025/24. Click to select a tax section. As an example, if your only income was dividend income, you could receive £13,070 of tax free.

Click to select a tax section. You can use the full personal allowance (£12,570) and the full dividend allowance.

How To Avoid Short Term Capital Gains Treatbeyond2, Dividends are normally taxed as the ‘top slice’ of income. As an example, if your only income was dividend income, you could receive £13,070 of tax free.

How to check If You Are Paying Too Much Tax, Click to select a tax section. An income tax rate of 8.75% is payable on dividends received between £500 and £37,200.

Your Queries Tax Capital gain on sale of inherited property, Your wages if you’re employed, or profits from being self employed. 2025/2025 tax rates and allowances.

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue, This is a reduction from the previous. Here’s a list of income that you could have to pay tax on:

TLCE Episode 3 Federal tax, For the 2025/25 tax year, dividend tax rates can range from 0% up to 39.35%, and your marginal rate of dividend tax is linked to your income tax band. Find out how much income tax you'll pay in england, wales, scotland and northern ireland.

Tax Form, 2025/2025 tax rates and allowances. An income tax rate of 33.75% is payable on dividends received between £37,201 and £150,000.

CBDT notifies ITR Forms and Tax Return Acknowledgement for AY, The current dividend tax rate is calculated via a combination of your income tax band and a dividend allowance. Your wages if you’re employed, or profits from being self employed.

tax rules on gift Important News! tax on gift received, Click to select a tax section. 2025/2025 tax rates and allowances.

Tax A photo of the tax square on monpoly. Li… Flickr, An income tax rate of 33.75% is payable on dividends received between £37,201 and £150,000. Here’s a list of income that you could have to pay tax on:

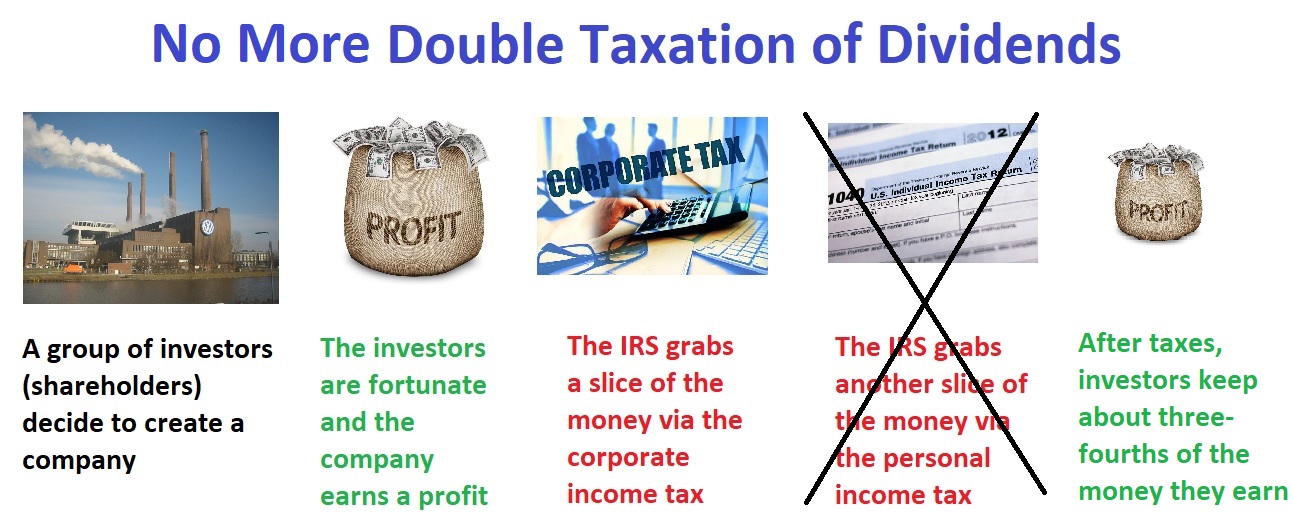

A Primer on Dividend Taxation International Liberty, An income tax rate of 33.75% is payable on dividends received between £37,201 and £150,000. This decrease means that individuals will.